The South Australian Law Reform Institute (SALRI) is calling for public submissions on whether there should be a state scheme for recording the location of, or securely storing, South Australians’ wills.

The South Australian Law Reform Institute (SALRI) is calling for public submissions on whether there should be a state scheme for recording the location of, or securely storing, South Australians’ wills.

The SALRI, located at the University of Adelaide, today issued a paper which examines what is currently available for those wanting to store their will in South Australia, and in other states and countries, and invites public to comment.

SALRI Deputy Director, Helen Wighton, says the current court-based facility for the secure custody of wills is almost exclusively used for court-authorised wills and is not designed for accepting a large number of wills.

“The only other options for secure storage of wills in South Australia are to make private arrangements (with a bank or solicitor, for example) or to appoint the Public Trustee as executor (who will store the will for you),” Ms Wighton says.

“Also, there is no system for simply recording a will’s location with a public authority. In British Columbia you can electronically notify the equivalent of our Registry of Births Deaths and Marriages that you have made a will and where it’s kept.”

Ms Wighton says the main purpose of any such scheme is to ensure that people’s property is distributed according to their wishes as expressed in their last will.

“If your will cannot be found after you die, your estate will be distributed according to the rules of intestacy, and will not necessarily go to the people you wanted it to go to,” she says.

“We’re looking for submissions from the legal profession, professionals involved in estate administration and the public.

“The Institute will then report its findings and recommendations to the Attorney-General.”

The review was initiated by the SA Attorney-General, the Hon. John Rau MP, as part of a wider review of succession laws in South Australia.

The issues paper, Losing it: State schemes for storing and locating wills, and information about how to make a submission can be found on the SALRI web page: http://www.law.adelaide.edu.au/research/law-reform-institute/.The closing date for submissions is Friday 12 September 2014.

The SALRI was established in December 2010 by agreement between the Attorney-General of South Australia, the University of Adelaide and the Law Society of South Australia. It is based at the University of Adelaide.

Media Contact:

Kate Bourne

Media and Communications Officer

The University of Adelaide

Phone: +61 8 8313 3173

Mobile: +61 (0)457 537 677

kate.bourne@adelaide.edu.au

Monthly Archives: July 2014

Majority of Divorcing Couples Settle Without Lawyers: AIFS Study

Although we take it as a given that conflict and property dispute are part and parcel of divorce, this is not necessarily the case with the majority of divorcing Australians, at least as far as this very recent study from the Australian Institute of Family Studies.

Although we take it as a given that conflict and property dispute are part and parcel of divorce, this is not necessarily the case with the majority of divorcing Australians, at least as far as this very recent study from the Australian Institute of Family Studies.

A recent large-scale AIFS study of post-separation property division in a decade — involving 9000 separated parents from around Australia — has found most divorcing couples manage to divide their assets themselves without lawyers.

In a presentation to the 13th Australian Institute of Family Studies conference on Friday, researchers will report that separating couples generally do not have a lot of money to split and mostly sort things out themselves fairly quickly, avoiding long battles.

AIFS senior research fellow Rae Kaspiew (nee Rae Aspire) said the findings were based on married and cohabiting parents who had been separated about five years, many with preschool or school children.

“We found that close to half had finalised their property division within a year, although this took longer if couples had more assets to divide. For example, of those with more than $500,000, four in 10 took more than two years to finalise settlement,” Dr Kaspiew said.

“By comparison, more than two-thirds of parents with under $40,000 in assets had resolved property division at the time of separation, but even many of those with considerably more property to divide had sorted things out in less than a year.

“Of those parents with assets to divide, the average property pool was $261,000. Married couples had generally accumulated more assets, compared to those cohabiting. Just over a third of those separating after marriage had assets of more than $300,000.”

Dr Kaspiew said separating parents had generally sorted out their own affairs. “The majority of separating parents had resolved property settlements without resorting to lawyers and courts, contrary to stereotypes about separation and painful fighting over assets,” she said.

Research co-author and AIFS senior research fellow Lixia Qu said most men and women judged their settlements fair although between 30 and 40 per cent did not.

The five-year study of 9000 separated parents found the average value of assets at separation is $202,900, including those who had no assets or debts.

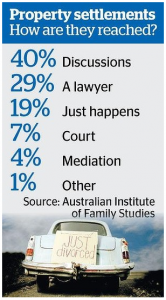

Dr Kaspiew said parents across all income levels had generally sorted out their own affairs, with 39 per cent of settlements achieved through discussions and 18.8 per cent ‘just happening’ without specific action.

A further 29.3 per cent were handled by a lawyer, 7.1 per cent went to court and 4.2 per cent went to mediation.

However, the involvement of lawyers rose as the assets in question rose in value.

When assets were under $140,000, most cases were handled through discussion but once values rose above $140,000, more cases went to a lawyer.

Dr Kaspiew said the study, the first large-scale, systematic analysis of property division in Australia for 13 years, had thrown up some interesting findings.

Cohabiting or de facto couples were likely to have fewer assets than married couples, generally because de facto couples tended to be younger and have spent less time together and so had less time to accumulate assets.

Dr Kaspiew said married couples’s higher wealth was also explained by their tending to come from higher socio-economic backgrounds.

The report found mothers received substantially more assets in a settlement when they were caring for children most of the time and that the parent who left the family house tended to receive less.

It also found fathers tended to over-estimate the share of property their ex-partner received, while both parents tended to underestimate their own share of a settlement.

“Factors associated with reports of unfairness related to an individual’s eventual share of the settlement; who left the house; and whether they had experienced family violence,’’ Dr Qu said. “Debate about fairness also focused on people’s views of how much they had contributed to the relationship in financial terms, as well as the value placed on particular roles, such as the care of children.”

The research surveyed parents of young children who were newly separated in 2008 and registered on a child support programs.

It will be presented to the Australian Institute of Family Studies conference in Melbourne on Friday.

The conference runs from July 30 to August 1.

Couple Were Rorting Centrelink While Living in Lebanon

It seems that some people would go to any lengths to ensure they continue to receive the very generous social security benefits offered in Australia to young families.

It seems that some people would go to any lengths to ensure they continue to receive the very generous social security benefits offered in Australia to young families.

We have often heard the argument that many illegal immigrants are not fleeing against tyranny, but running towards a welfare system that is second to none in their eyes.

Our welfare system seems to be leaving a long-lasting impression not only on illegal immigrants, but on those with Australian citizenship who have chosen to live abroad.

In this case, we have a married couple who have chosen to live in Lebanon, but have frequented Australia for the birth of each of their children, solely it is claimed by the wife for the purpose of claiming a raft of family-based welfare payments.

Two first cousins in an arranged marriage are being investigated for immigration and Centrelink fraud and rorting the baby bonus by returning to Australia from Lebanon for the births of some of their seven children.

The woman, 33, told the Federal Circuit Court sitting in Parramatta her husband also had her return several times to Australia solely to update Centrelink details so she could continue to get social security.

The family was receiving Family Tax benefits that in the last financial year totalled $25,265.74, despite three of their children having lived in Lebanon since 2009, Judge Joe Harman said.

“On at least two occasions (the mother) returned to Australia for a brief period purely to allow the child then carried by (her) to be born in Australia and to then receive the baby bonus then operating,” the judge said.

The case was before the court because the Australian-born mother is applying for the return of her three eldest children, aged 12, 10 and nine, from Lebanon and custody of all seven children.

The others are aged seven, five, three and two. The eldest live with their father’s brother and paternal grandmother in a mountain village.

The now-estranged couple wed in Lebanon in 2001 two weeks after meeting in an arranged marriage. They returned to Australia and lived for a time with their relatives — the woman’s sister is married to the man’s brother.

The husband, 39, was granted citizenship in 2006 in circumstances which Judge Harman said troubled him since the couple had decided to live in Lebanon.

“It is concerning (the man’s) evidence is his citizenship was granted in 2006 at the very time when, consistent with his evidence, he had formed the desire and intention to live permanently in Lebanon and to return to Australia … solely for the purpose of earning a greater income than was available to him in Lebanon, and returning the funds to Lebanon,” the judge said.

“There would appear to be, at least potentially, some anomaly as regards the eligibility requirements for citizenship at the time the application was made … (and) whether it was obtained on the basis of full, frank and candid disclosure or otherwise.”

He said he would refer the case to the Immigration and Human Services departments for investigation.

The woman, who alleged her husband was violent toward her, was met at the airport by the Australian Federal Police when the pair returned to Australia in March.

The judge refused the father permission to leave Australia and put him on the Airport Watch List until he has facilitated the return to Australia of the eldest children.

The hearing resumes at the end of this month.

In response to this case, some people have argued that our welfare system is an easy touch for scammers, even if they live far from Australia.

This is a shocking demonstration of how low the bar is set for policing of our welfare system. It is fair to worry about the extent of welfare fraud when cases like this occur.

Big Sydney Divorce with Bizarre Home Sale ends in Property Transfer

Lisa Poulos involved in big money Sydney divorce

Another example of divorcing men trying to out-smart the system, but in most cases simply ending up with egg on their face.

In this case a successful businessman did everything in his power to prevent his estranged wife from residing in the former matrimonial home, even concocting a late night fire sale of the house to a mystery buyer.

The NSW Supreme Court saw right through the intent of this transaction, and ordered a property transfer back to the wife, with Hans Eberstaller left to carry the quite significant legal costs and penalties involved in such a charade.

Despite appeals to the NSW Court of Appeal and the Judicial Commission, this is a case where it was patently obvious what the man was trying to secure, and the Court typically has very low threshold of tolerance for such tactics.

It’s being dubbed Sydney’s War of the Roses: a bitter marriage breakdown, a bizarre property deal and claims the city’s men are being turned from daytime lions to “pussycats at home”.

Business executive Hans Eberstaller’s late-night decision to sell his family home to a man who had never seen the property and paid no deposit has produced a stinging legal rebuke and he and the mystery purchaser have been hit with a $150,000 legal bill and the sale cancelled.

Mr Eberstaller’s actions would have put his estranged wife, public relations agent and former publisher of Elle magazine Lisa Poulos, and the couple’s children, out on the street.

“His intention towards his wife was not merely unreasonable, it was dishonest by the standards of ordinary, decent people,” said Justice Michael Pembroke of the NSW Supreme Court.

“You’ve seen War of the Roses,” said Mr Eberstaller said of his bitter marriage breakdown. He also suggested that when “eastern suburbs wives” were “no longer happy with their man” they go to court to get the matrimonial home.

Fear of this happening was turning men who were ‘‘lions in their business” into “pussycats at home”, he claimed.

On August 12, 2013, within weeks of Ms Poulos’ confronting tale of her double mastectomy airing on the ABC’s Australian Story, Mr Eberstaller exchanged contracts at 10 o’clock at night for the sale of the couple’s Bellevue Hill mansion to a man who had never seen the property and who paid no deposit.

“There is nothing mysterious about it,” Mr Eberstaller said. “I’ve been in banking and finance for 30 years and most deals are done at four in the morning so ten o’clock in the evening is pretty early actually.’’

The agreed purchase price was $2,350,000, which was $1 million less than a valuation Mr Eberstaller had obtained in 2009.

“For all I know, he could be an illusion,” said Justice Pembroke of the mystery purchaser, Premjit Singh.

Mr Eberstaller said he had never met Mr Singh despite Mr Singh being listed as a co-director with Mr Eberstaller in two companies, one of which owns a tavern in Innisfail and the other is developing a former drive-in site south of Cairns.

Mr Eberstaller said Mr Singh’s son Ranjit, a Cairns property lawyer, was his business associate and that Ranjit organised for his father to buy the property because the bank was about to foreclose on Mr Eberstaller and he did not wish to have a bad credit rating.

“An urgent fire sale is how you strike a good bargain,” Ranjit Singh said. “The key in business is if you know someone has a potential weakness, you exploit it.”

But Justice Pembroke dismissed Mr Eberstaller’s claim about the bank foreclosing.

Describing his behaviour as “obdurate and obstinate,” the judge said he put “one obstacle after another in the way of his wife’s entitlement to have the property transferred to her name.”

The court heard that for months Ms Poulos had been trying to give her husband a bank cheque to pay out the $640,000 mortgage upon which Mr Eberstaller had to transfer the house to her.

The judge said his “wholly unreasonable lack of co-operation” was because of his “desire to hinder, delay or prevent his wife” from having the house.

“He thwarted her and engineered a sale to the second defendant … rather than to allow his wife to have the former matrimonial home.”

After a two-day hearing in December, Justice Pembroke set aside the contract to sell the house to Mr Singh and ordered Mr Eberstaller to transfer the property to his wife, which he did.

In May Justice Pembroke ordered Mr Eberstaller and Premjit Singh to pay Ms Poulos’ court costs of $148,278, which they are yet to do.

The NSW Court of Appeal recently rejected Mr Eberstaller’s appeal on jurisdictional grounds.

The businessman has lodged a complaint about Justice Pembroke to the Judicial Commission, claiming apprehended bias.

“He made a character assassination in order to scare me off. I am a managing director and I have 3500 employees and I have never had someone say that to me ever,” Mr Eberstaller said.

Ms Poulos declined to comment.

Four Women Fight Over estate of Notorious Solicitor

Solicitor Michael Ryan and Marie Christos

This is another sordid case becoming more and more frequent with the changing nature of relationships in Australia, which highlights the difficulty in determining whether a relationship was simply casual or de facto.

This is the case of notorious solicitor Michael Ryan, who had numerous lovers, many of them prostitutes, who have all made claims on his $8m estate as his de facto lovers, with varying degrees of success.

As a solicitor, multi-millionaire Michael Ryan shot to notoriety when he appeared for former judge Marcus Einfeld as he tried to get off a $77 speeding fine by blaming it on a dead woman.

As a lover, Mr Ryan’s private life was just as complicated — as the Supreme Court was told during a fight between four women, three of them prostitutes, over his $8 million estate.

Marie Christos withdrew her claim because of legal costs; Denise de Bono settled out of court for $115,000; and Gillian Crighton — the only one who was not a prostitute — received $20,000 in another out-of-court payment.

Janet Amprimo, who sued for $2.8 million, walked away with nothing but a potentially large legal bill after Justice Nigel Rein on Thursday found that, although she was one of Mr Ryan’s mistresses, there was no evidence they lived in a de facto relationship.

The judge found their relationship was “well and truly over” when Mr Ryan died alone in his Fairlight mansion in 2012 after selling his legal practise and becoming a recluse amid the controversy surrounding the Einfeld case.

Justice Rein said Mr Ryan met Ms Amprimo at Melbourne brothel, the Daily Planet, where she had worked for some years. Between 1996 and 2006, she stayed in Sydney hotels and a Kirribilli apartment at Mr Ryan’s expense but also worked at Sydney brothel, the Penthouse.

Ms Amprimo said she knew Ms Christos from the Penthouse and Ms de Bono from the Daily Planet. During those years, Mr Ryan was also seeing Ms Crighton while taking Ms Christos on luxury cruises and visiting Ms de Bono in Melbourne.

The six-year relationship between Ms Christos and Mr Ryan broke up two months before she found documents relating to the Einfeld case — which she took to police and the media — while searching Mr Ryan’s bin in August 2006 for evidence of another woman. Marcus Einfeld later served two years after pleading guilty to perjury for blaming driving offences on other people.

The judge said he accepted evidence from Philippa Duncan, a friend of Mr Ryan, that on August 22, 2006, he gave her Ms Amprimo’s mobile number and asked her: “Would you just call and say that I am unable to see her any more and that she should just go away.”

Justice Rein said Ms Amprimo had never mentioned the word “love” in any of her affidavits. He said he accepted a man could have a de facto relationship with a prostitute and such a relationship could exist while two people lived in separate homes but there had to be some romance and that had ended for Ms Amprimo and Mr Ryan in 2006.

He adjourned the case for a decision on costs.

Paul Hogan and Linda Kozlowski Divorce After 23 Years

Hogan and Kozlowski

AFTER 23 years together, Paul Hogan and Linda Kozlowski have finalised their divorce, which will allegedly see Linda Kozlowski receive US $5.775 million (AU $6.25 million) of Hogan’s US $20 million (AU $21 million) fortune.

Hogan is keeping the rights to his iconic Crocodile Dundee character and the film company that produced the films, as well as ownership of their home in Venice Beach, California.

Linda Kozlowski will reportedly be able to remain living in the house for another four years, or until she remarries, whichever happens first. She also has the option to buy the house outright at the original purchase price of $US1.59 million.

The couple will reportedly have joint custody of their 15-year-old son Chance, and neither will pay child or spousal support.

It is unknown if Paul Hogan and Linda Kozlowski had entered into a pre-nuptial agreement prior to getting married,

Hogan cast Kozlowski as his love interest in 1986’s Crocodile Dundee, where a romance blossomed and Hogan subsequently split with his first wife Noelene Edwards soon after.

Hogan, 74, and Kozlowski, 56, married in 1990 after the release of the film which made Hogan a global star.

Previously, Hogan had five children with ex-wife, Noelene, whom he divorced (for the second time) in 1986.

Paul married his first wife Noelene Edwards in 1958, the year that Linda was born, and divorced her for the first time in 1981. The couple had five children together.

They remarried just a year later but divorced for a second time in 1986, when it is alleged that the comedian started his relationship with Linda.

Hogan, it seems, hasn’t given up on love, even at his advanced age, recently stating that:

“The secret to love and women is — if you’re lucky, you get a good one, and they stick around.

“If you’re real lucky, they’ll stick around for a long time. If not, you move on. But,” Hogan smiled cheekily, “I haven’t given up.”

Prior to splitting with Kozlowski, Hogan was at the centre of a long running Australian Tax Office (ATO) investigation for tax evasion. After returning home to attend his mother’s funeral in 2010, he was prohibited from leaving the country, which resulted in a public stand-off with the taxation department. No charges were ever laid and he settled for an undisclosed sum in 2012.

Another Big Money Australian Divorce for the Lews

Another big money divorce in Melbourne, Australia between billionaire Solomon Lew and wife Rosie Lew.

Another big money divorce in Melbourne, Australia between billionaire Solomon Lew and wife Rosie Lew.

Solomon Lew has been seen with a pretty blonde of Greek heritage many decades his junior who has been by his side since he ended his 45-year-marriage to Rosie. The 40-something, Melbourne single mother of two is Rosa Prappas.

Solomon Lew, 69, separated from his wife last February. Friends of the couple say Rosie Lew is keeping a “dignified” silence on the matter, although privately she is said to be “extremely bitter” about the end of the marriage.

Rumours have been rife that Rosie Lew will walk away from the marriage with a settlement worth about $300 million.

Rosa Prappas is the woman who has been living in Lew’s multi-million dollar penthouse apartment in downtown Melbourne. She will be joining the retailing mogul in the first week of August as they join 80 other guests heading off to Mykonos for the combined birthday celebrations of Lew’s right hand man Mark McInnes and his partner Lisa Kelly.

Although Lew is enjoying the good life for now, his imminent divorce is part of a broader family collapse over recent years that could at one point unravel the secrecy and control Lew has held over his massive fortune for decades.

Solomon Lew’s daughter Jacqueline had been embroiled in a bitter matrimonial dispute with her former husband Adam Priester, while his son Steven Lew was involved in divorce proceedings with his estranged wife Sarah Nowoweiski.

Both cases were before the Family Court, which bans any media coverage. But the private feuds had spilled into the public domain in dramatic style.

Lew’s 2012 writ in the Supreme Court of Victoria was a pre-emptive strike to protect part of his family’s $621 million Lew Custodian Trust from Priester and Nowoweiski, who are parents to six of his grandchildren.

The case could have serious implications for Lew. Aside from the vast fortune at stake, Priester and Nowoweiski have been the custodians of business and family secrets that could be exposed in court.

The dispute centred on a longstanding agreement between Lew and his three children, Peter, Jacqueline and Stephen, who each received $170 million but agreed to cede control to their parents.

While the deal is believed to have never been documented, each child would receive $25 million in loan accounts in their own names, with the remaining $145 million to be gifted back to Lew and his wife Rose.

According to Lew’s senior counsel, Leslie Glick, the arrangement was designed to minimise tax, at a time when the former Howard government was contemplating a tax on the undistributed reserves from family trusts in 1999.

The tax never happened, but the deal remained in place, and only became an issue when the marriages of Jacqueline and Stephen unravelled.

Abbott Government Considers Paying Child Support to Single Parents

The Nationals George Christensen

The government could pay child support to single parents regardless of whether the other parent pays, under a proposal being considered by a parliamentary inquiry – potentially adding more than $1bn to the budget if the debts are not recovered.

Senior lecturer at the University of Tasmania’s school of social sciences, Dr Kristin Natalier has recommended taxpayers foot the bill of the amount owed so single parents and their children are not financially disadvantaged.

In her submission to the inquiry into the child support program, Dr Natalier said there were high rates of non- payment, partial payment or late payment of child support.

National party MP George Christensen, chair of the committee inquiring into child support which has a public hearing in Brisbane on Tuesday, said the system was raised by a number of single mother advocacy groups and he was not opposed to the idea.

Submissions to the Inquiry into Child Support

“The idea was raised with us and I am not opposed to it, it has its merits but one of the problems we will look into is potentially how much it will cost – but we are not ruling it out,” Christensen said.

At the moment, “payers” – who are usually non-custodial parents – pay child support to the department of human services (DHS) and then the DHS pays the “payee” – usually the custodial parent.

George Christensen said there were a number of jurisdictions around the world where the government guarantees the child support payment regardless of whether it is received from the payer. It is then up to the government agency to chase down the child support debt from the parent.

A submission by the Council of Single Mothers and Their Children (CSMC) estimated Australia’s unpaid child support bill was over $1bn, “yet even this figure does not capture child support that goes unpaid in private collection arrangements and debts waived by child support”.

“Calculating unpaid child support from private collect (sic) and waived debts would more than likely triple this figure,” the CSMC submission said.

“Less than 50% of child support payments are made in full or on time, yet there are few real consequences for paying parents defaulting on their child support obligations.”

Labor deputy chair Sharon Claydon said while she had concerns that a government guarantee might allow some parents to shirk their payment responsibilities, the advantage of a guarantee would be to “take the emotion” out of the system.

“From a taxpayer and public policy maker’s view we really have to ensure the capacity of the commonwealth to be a debt collector,” Claydon said.

“Some payers are delaying payment as a means of exercising financial control over the situation, that is why it has been an attractive proposal for some single mothers groups and the lone fathers have found it interesting as well.”

Alleged Unfairness in the System

George Christensen said the other main issue facing the inquiry was “alleged unfairness” in the system, particularly in regard to “payer” parents.

George Christensen said a common problem reported in submissions occurs where a child support “payer” had court ordered custody arrangements which are breached by the “payee” moving away, leaving the payer parent unable to see their children.

In such cases, when the payer parent can no longer maintain their custody arrangements due to distance, the payee applies for a reassessment of the child support amount and the payer is left with a larger child support payment.

George Christensen said parents reported that the department was often aware of a breach of court orders but enforced the reassessment regardless. One of the terms of reference requires the committee to consider how to improve the link between the the Department of Human Services and the Family Court.

“We are looking for linkages at the family court end to ensure those problems don’t arise,” George Christensen said. “(Payer parents) see (reassessment) as salt being rubbed into a wound. Anecdotally, that is where a lot of suicides occur.”

The inquiry will hold ongoing public inquiries and is not expected to report until the end of the year when Christensen expects it will make recommendations that the government can “pick up and run with”.

Sharon Claydon said in her experience, the child support system was “generally working ok” though for families with “entrenched conflict”, there were still significant issues, including around domestic violence and cultural issues for Indigenous families.

“Sometimes conflict has been there for a long period of time so we will be working through those issues and I don’t think we have landed on the magic solution yet.”

Calls For New Tribunal to deal with Family Violence

ONE of the nation’s top judges has called for a separate, less formal tribunal to deal with family law cases involving extreme domestic violence, arguing that the current adversarial system is not the right place for women who have been badly abused. Federal Circuit Court chief judge John Pascoe told The Australian he believed a new approach was also needed for cases involving serious mental illness.

ONE of the nation’s top judges has called for a separate, less formal tribunal to deal with family law cases involving extreme domestic violence, arguing that the current adversarial system is not the right place for women who have been badly abused. Federal Circuit Court chief judge John Pascoe told The Australian he believed a new approach was also needed for cases involving serious mental illness.“I wonder whether some sort of tribunal where there can be a different sort of approach that reduces the trauma of having to perhaps be cross-examined on really, really often horrific events would work better,’’ he said.

The Federal Circuit Court handles most family law cases and deals with domestic violence and mental illness every day, including in the context of parenting disputes. Chief Judge Pascoe said he worried that a formal, adversarial court environment did not encourage maximum disclosure by women who had suffered domestic violence.

“Part of the tragedy for battered women in particular is often they are very reluctant to disclose (what has happened to them),” he said. “We have an adversarial system, where each person is entitled to hear the evidence of the other, and some women feel very, very threatened by that.” Chief Judge Pascoe said he had a “similar concern” that the adversarial system was not necessarily the best way to determine disputes involving people with a serious mental illness.

He said those cases often took up a lot more court time. “How do we make sure that they are properly heard?” he said. “Sometimes they present very strangely but there’s a real issue that they’re entitled to have heard and determined by the court. It’s being able to build a structure that enables them to get those issues on the table … “Those people often need huge compassion.”

Chief Judge Pascoe’s call for a separate tribunal for cases involving domestic violence comes after the NSW Director of Public Prosecutions, Lloyd Babb SC, told the royal commission into child sexual abuse that a separate court for sexual assault should be established. Mr Babb said that some judicial officers and prosecutors were better at handling those cases than others.

Chief Judge Pascoe said proper Legal Aid resourcing was also crucial to assist women who had experienced family violence. “Things like Legal Aid resourcing become very, very important so those women feel protected,” he said. Those calls were echoed yesterday by former Family Court chief justice Alastair Nicholson, who said judges did their best to be sensitive in cases involving serious violence or sexual abuse but sometimes the set-up of the court was “too formidable”. “I think there’s room for a lot less formality and a better structure in those sorts of cases,” he said.

Mr Nicholson believed cuts to Legal Aid funding had exacerbated the problem. “You’ve got the unfortunate situation for someone who’s the victim of domestic violence being cross-examined by the perpetrator and it’s quite terrifying,” he said. “We really should address those issues. Domestic violence advocates have backed calls for changes to the way courts approach serious family violence, with some calling for a separate tribunal to handle such cases and others calling for more help for women to navigate the system.

Rape and Domestic Violence Services Australia executive officer Karen Willis said she strongly supported the call for a separate tribunal to handle such cases, and believed criminal cases involving domestic violence and sexual assault should also be moved to a less formal environment. Ms Willis said the court system was intimidating for many who had experienced violence and they had “absolute fear” of facing their abuser. “At that point women are scared out of their brains and often rightly so.”

North Queensland Domestic Violence Resource Service director Shirley Slann believed judges and magistrates in the criminal and family law systems, as well as police prosecutors, needed to be better trained so they understood family violence. Women’s Legal Services NSW executive officer Helen Campbell said resources should be directed to provide extra support for women to navigate the current system, rather than on creating a separate tribunal.

Self-employed dads avoid paying higher child support

Fathers who run their own businesses are declaring lower incomes to the Australian Tax Office to avoid paying higher rates of child support, Victoria Legal Aid says.

Fathers who run their own businesses are declaring lower incomes to the Australian Tax Office to avoid paying higher rates of child support, Victoria Legal Aid says.

The organisation will discuss its clients’ difficulties in both receiving and paying child support at a federal inquiry into the child support program in Melbourne on Friday.

Its Child Support Program manager Jayne Ford said that most of the parents applying to change the amount they received were women who argued their self-employed ex-partners could afford to pay more. The payers – who were mostly men – could have legitimately declared lower taxable incomes by making deductions for their home office and telephone expenses.

“But their business might be rolling over quite a lot of money and they might have other resources,” she said. “They’re certainly able to pay more child support and the bottom line is that the children are missing out and not being adequately supported.”

While some were not declaring lower incomes to pay less child support, others were “well aware” this would lessen their obligation to pay.

In a submission to the inquiry, Legal Aid says the Department of Human Services should make note of self-employed parents, so that it could review the amount they were required to pay “at appropriate intervals”.

Meanwhile, many parents paying child support found it hard pay or reduce child support payments they could not afford to pay, when their financial circumstances had been incorrectly assessed.

Ms Ford said prisoners were often unaware they had to inform the department they were in jail and were unable to continue paying the same level of child support: “They may be in prison being assessed on the income they earned before they were imprisoned … accumulating a large debt without knowing it.”

This could include thousands of dollars in penalty payments, which made it harder for them to move on with their lives when they were released.

Legal Aid recommends that only those prisoners who were paid wages for work done in prison should have to pay a minimum amount of child support.

A report on the inquiry, which is looking at the way child support is collected and managed, is expected to be published in 2015.