Where there is an irretrievable breakdown of a marriage, the party’s can apply for a divorce. An application for divorce is available 12 months after the date of separation. The Court must be satisfied that you and your partner have lived separately for a continuous period of 12 months and are unlikely to resume co-habitation. When approaching the Courts, the parties mainly have two matters which they typically seek a larger slice of; custody of the children, and ownership of property.

Where there is an irretrievable breakdown of a marriage, the party’s can apply for a divorce. An application for divorce is available 12 months after the date of separation. The Court must be satisfied that you and your partner have lived separately for a continuous period of 12 months and are unlikely to resume co-habitation. When approaching the Courts, the parties mainly have two matters which they typically seek a larger slice of; custody of the children, and ownership of property.

Property settlement often becomes a contentious issue and causes many disputes which end up in bitter, costly and time consuming litigation. Hence, it is important for one to clearly understand the factors which affect property settlement before engaging in legal battles. In this series of articles I will discuss the following areas:

Part 1 – How the Courts Divide the property in the case of a divorce or separation

Part 2 – Divorce & Property : The tax implications and what to look for

Part 3 – How to protect property in the event of divorce/separation

What is marital property ?

Every time the parties engage in a legal battle for dominion over matrimonial property the first thing they do is to map out a list of property. It is very important that you list out all types of property because some tend to forget not so visible but often significant assets like superannuation, licenses etc. These assets could also entail unforeseen issues, such as being encumbered by loans in which case the loan comes with the asset.

The loans may create a financial burden on the spouse who obtained the asset as it will expect the owner to service the loan by paying the monthly instalments.

However, the implication may be even more daunting, as in most relationships the partner may sign as a Guarantor to the loan, such as that of a loan to purchase the family house. In the event of a divorce, if the partner who obtains the property with the Loan defaults, the Guarantor will have to pay for that. These are commonly termed as ‘STD’ or ‘Sexually Transmitted Debt’. 1

Hence, dealing with property division is often comparable to walking on a mine field with hidden contingencies.

I have listed below the commonly applicable types of assets and liabilities which would help you to think through the process of listing all matrimonial property;

Assets

- – Pre-marital property brought into marriage

- – Bank accounts

- – Vehicles

- – land and buildings

- – shares and bonds

- – life insurance

- – interest in a partnership

- – household contents

- – redundancy payments

- – Superannuation

- – Licenses and trademarks

- – overseas property

- – assets on trust

- – future bequests under irrevocable wills

- – receivables

Liabilities

- – personal loans

- – mortgages

- – credit card settlements

- – overdrafts

The task of identifying and finding the value of assets may not be as daunting as you might think, if you have access to the right tools. You may consider using various web oriented software such as Divi to make your life easy.

Who get what? Is it always the call of the Courts?

It is not always the slam of the gavel by the judge which determines the division of property. More often, the parties nowadays decide and agree on a certain formula before approaching Courts. This has its advantages as it significantly reduces the cost of litigation. After all no one wants to feed the lawyers the bulk of their share before it gets split, do they?

In the event the parties agree on a satisfactory formula, they can refer it to Family Court to formalise the agreement by way of a consent order. If you are thinking about rushing to Courts with a half baked formula decided between you and your former partner, I need to warn you that not all financial agreement are deemed to be valid and enforceable under the law.

The agreement needs to satisfy the following criteria. 2

- – the agreement is in writing and signed by both parties;

- – the parties have signed a statement specifying that they have received independent legal advice from a lawyer in regards to specific matters;

- – certification from the lawyers which is attached to the agreement;

- – the agreement is not to be terminated or set aside; and

- – a signed copy is given to each of the parties to the agreement.

In some instances the parties argue that certain property divisions in the Agreement are against public policy, however, Court decisions indicate that the Courts generally go by what is agreed between the parties and seldom decide on public policy. 3 However, if the Agreement is silent on a particular property which needs to be divided, Courts are allowed to make such orders. 4

The 50-50 rule

There is a misconception among many that the split of property has to be equal. This may be the norm, but the Courts can, and have, on many occasions decided against a 50-50 split. 5

Generally speaking, the court considers issues such as financial and domestic contributions, and what is just and equitable.

How do the Courts decide on the “Just and Equitable” factor?

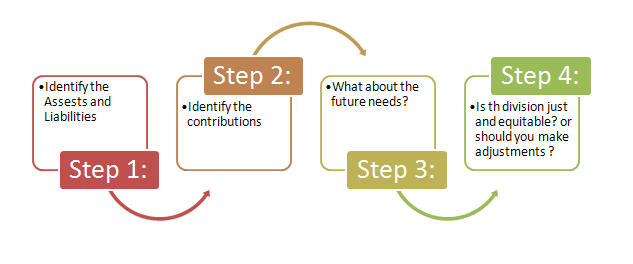

The Family Law Act 1975 sets out the general principles the court considers when deciding financial disputes after the breakdown of a marriage. 6 The general principles are the same, regardless of whether the parties were in a marriage or a de facto relationship. The Courts in 2003 devised a mechanism which is famously called the 4 step process when determining what is ‘just and equitable’ to the parties. 7

Let’s try to identify the elements of the four steps and how the Courts have dealt with each element.

Let’s try to identify the elements of the four steps and how the Courts have dealt with each element.

How to value the property. In this section I have listed out some unique instances which one might come across when dividing and determining the value of the property. To better understand this, I have listed them in accordance with the 4 steps mentioned above.

Step 1: Requires all assets and liabilities to be identified. This includes superannuation entitlements, as well as assets held personally, in partnership, in trusts, or companies. |

What happens to property that was owned before the marriage?Case law suggests that at the beginning of the marriage, greater weight will be given to the properties owned individually. However, the importance of property brought into a marriage initially is eroded the longer a couple stays married.How are lottery winnings and other windfalls divided?

Based on the facts, lottery winnings and other windfalls that come from the joint funds of a marriage and are likely to be split equally by the courts. 8 What about properties held in Trust ? Trusts can cause some confusion. For example you may hold property in your name for and behalf of your parents, or conversely someone else may hold your property on your behalf. Law would recognize the beneficial ownership and care must be make necessary adjustments to understand who is the real beneficial owner. 9 What if one party disposes the property reducing the pool of assets for distribution? In certain instances one of the parties may get into an arrangement to dispose a substantial asset with an agreement to repurchase it after the Courts decide on the property distribution. By doing so, the property pool at the time of approaching Courts can be severely eroded making the other partner loose out. 10 The Courts have a right to nullify these type of arrangements if the party affected apply to Courts. 11 How are Superannuation Funds valued? The superannuation splitting law treats superannuation as a different type of property. It lets separating couples value their superannuation including the accrued interest and split the superannuation payments which they would eventually receive. The court is required to value the interest in accordance with any method set out in the Family Law (Superannuation) Regulations. 12 The said Regulations spell out the method of calculation depending on whether the value and the interest is paid on as a lump-sum or as a pension. |

Step 2: Requires the identification of what contributions (if any) each party made to the acquisition preservation improvement or maintenance of any asset. This includes not only financial contributions, but also non-financial contributions, and contributions as a parent and homemaker. |

How is property divided for homemakers ?As highlighted by Professor Patrick Parkinson, recent cases have given more emphasis in assessing the needs of the homemaker. 13 The Courts have taken the view that the role of the homemaker should not be taken lightly and the role should be assessed and valued in terms of the cost it would have saved the family. This does not suggest that the Courts value the contribution at the commercial rate, like the rate for child care, or the rate of a chef etc. 14

What happens to business property in a divorce? Case law in Australia suggests that if one party is involved in a business, the other party is still entitled to some share of the profits. 15 FamCA 688 – http://www.austlii.edu.au/au/cases/cth/FamCA/2002/688.html. ] Judges again have discretion on how the business property is divided on the facts of each individual case, as well as the just and equitable requirements under the Act. |

Step 3: The Court decides whether any adjustment is required for the future needs of each party, taking into account matters such as care of children, disparity in income earning capacity, health, age and availability of financial resources. |

Does it matter as to who uses the property more? The use and maintenance of the property during and after separation is also another factor that the courts will consider in their assessment of how to divide property assets. In the instance where the one of the spouses stay separated for over an year at his or her parents place, would effectively weaken his/her case to state that he or she requires more assets to maintain himself and pay for rent as he or she is deprived of the matrimonial property. |

Step 4: The Court must stand back and ensure, at the end of this process, that the proposed asset division is just and equitable. |

Can Courts shift the balance to minimize hardship? In a recent case (2012) the Courts took the view that once the assets are divided, no party should be faced with sever hardships. 16 HCA 52 http://www.austlii.edu.au/au/cases/cth/HCA/2012/52.html. ] In this case the husband was allowed to keep the matrimonial home which was the substantial asset, taking into consideration his age and health, even though this meant that the major share of the assets divided in favour of the husband. |

The last case I discussed to an extent changed the way Courts look at the 4 step process. It concentrated on the end result and its effects rather than the process of balancing the financial needs.

After following the four steps, a party can request spousal maintenance. However, spousal maintenance is only given if one person can financially maintain the other person and the other person cannot maintain themselves because of age, mental or physical incapacity, because of a child under 18 in their care or any other adequate reason. The court will consider a range of things when deciding on whether to grant spousal maintenance. You should seek legal advice if you want to apply for spousal maintenance.

You may just have the bed linen to fight over, or it could be an entire kingdom, the principles are same. Hence its best that you carefully consider how the property division is determined and how much you would likely be awarded, before you venture into costly litigation for more.

- See Chapter 13 – Sexually Transmitted Debt http://www.alrc.gov.au/sites/default/files/pdfs/publications/ALRC69_Pt2.pdf .

- The criteria are spelt out in section 90G of the Family Law Act (1975); as discussed in Senior v Anderson (2011) FLC 93-470 it is only if the judges hold that the financial agreement is invalid, that they proceed to decide outside the ambit of the Agreement.

- See Mohamed v Mohamed (2012) NSWSC 852 – http://www.austlii.edu.au/au/cases/nsw/NSWSC/2012/852.html.

- Section 90 G (2) of the Family Law Act; see also Pascot & Pascot (2011) FamCA 945 – http://www.austlii.edu.au/au/cases/cth/FamCA/2011/945.html.

- Section 79 of the Family Law Act.

- See Sections 79(4) and 75(2)) or a de facto relationship (see Sections 90SM(4) and 90SF(3).

- See Full Court in Hickey v Hickey and the Attorney General for the Commonwealth of Australia (Intervenor) 2003 FLC 93-143 – http://www.austlii.edu.au/au/cases/cth/FamCA/2003/395.html, although the approach had been established in earlier authorities.

- There is a line of United States case law which recognizes the “community property” In re Mahaffey, 206 Ill. App. 3d 859, 564 N.E.2d 1300 (1990); In re Marriage of Swartz, 512 N.W.2d 825 (Iowa Ct. App. 1993); Smith v. Smith, 162 A.D.2d 346, 557 N.Y.S.2d 22 (1990); Ullah v. Ullah, 161 A.D.2d 699, 555 N.Y.S.2d 834 (1990); DeVane v. DeVane, 280 N.J. Super. 488, 655 A.2d 970 (App. Div. 1995).

- See Grace v Grace (No 2) (2012) NSWSC 1321 -http://www.austlii.edu.au/au/cases/nsw/NSWSC/2012/1321.html.

- See Cleary & Cleary (1999) FamCA 286 (http://www.austlii.edu.au/au/cases/cth/FamCA/1999/286.html.

- The right is granted in section 85 of the Family Law Act to nullify such agreements.

- See http://www.austlii.edu.au/au/legis/cth/consol_reg/flr2001397/.

- Parkinson, Patrick. , Qualifying the homemaker contribution in family property law – http://flr.law.anu.edu.au/sites/flr.anulaw.anu.edu.au/files/flr/Parkinson_0.pdf.

- See Apostolidis & Ors v Kalenik & Ors (2011) VSCA 307- http://www.austlii.edu.au/au/cases/vic/VSCA/2011/307.html.

- See Figgins v Figgins [2002

- Stanford v Stanford [2012

Dinesh Munasinha

Latest posts by Dinesh Munasinha (see all)

- Divorce and Property Dispute: Preparing for Litigation - July 30, 2015

- Everything you need to know about Family Trusts: Part 2 – Avoiding Pitfalls - November 8, 2014

- Everything you need to know about Family Trusts: Part 1 - August 21, 2014